Wow! The 425 Show is officially 3 years old! Supporting local businesses and sharing what makes this such a great place to live has always been a passion of mine. I’m grateful that the show gives me a chance to do that every week. We thought it was only fitting to celebrate with Vanessa Rimkus Loan Officer of Fairway Mortgage.She was the very first guest we had on the show and joined us again to celebrate our milestone.

Since 1999 Vanessa has been passionate about helping her clients get into their dream home, and help lower their payments through refinancing their current loan.

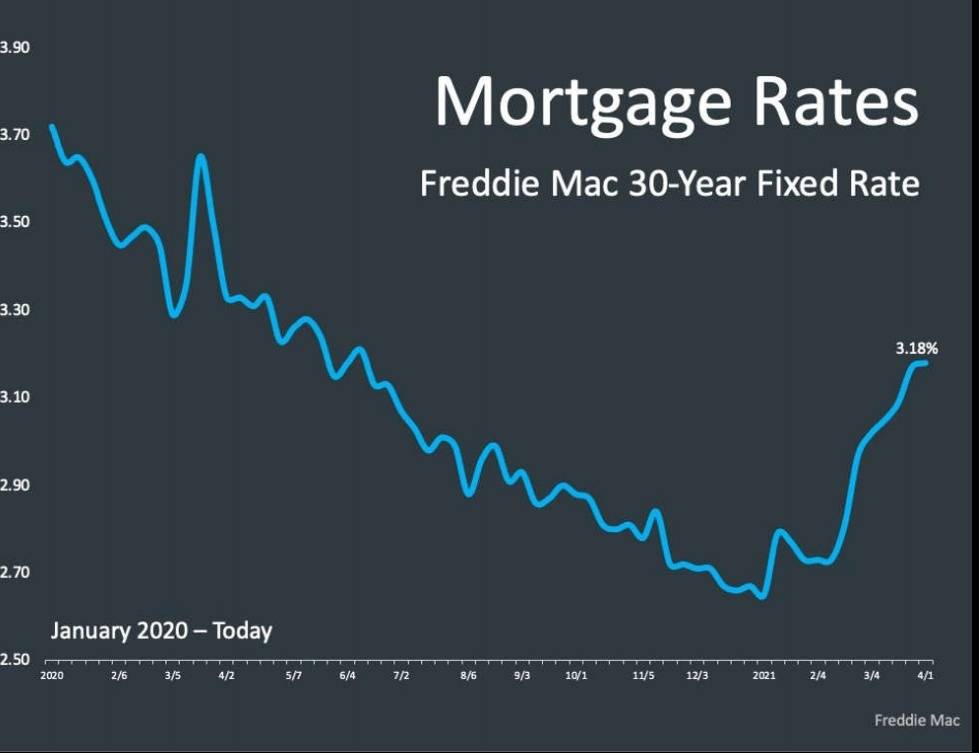

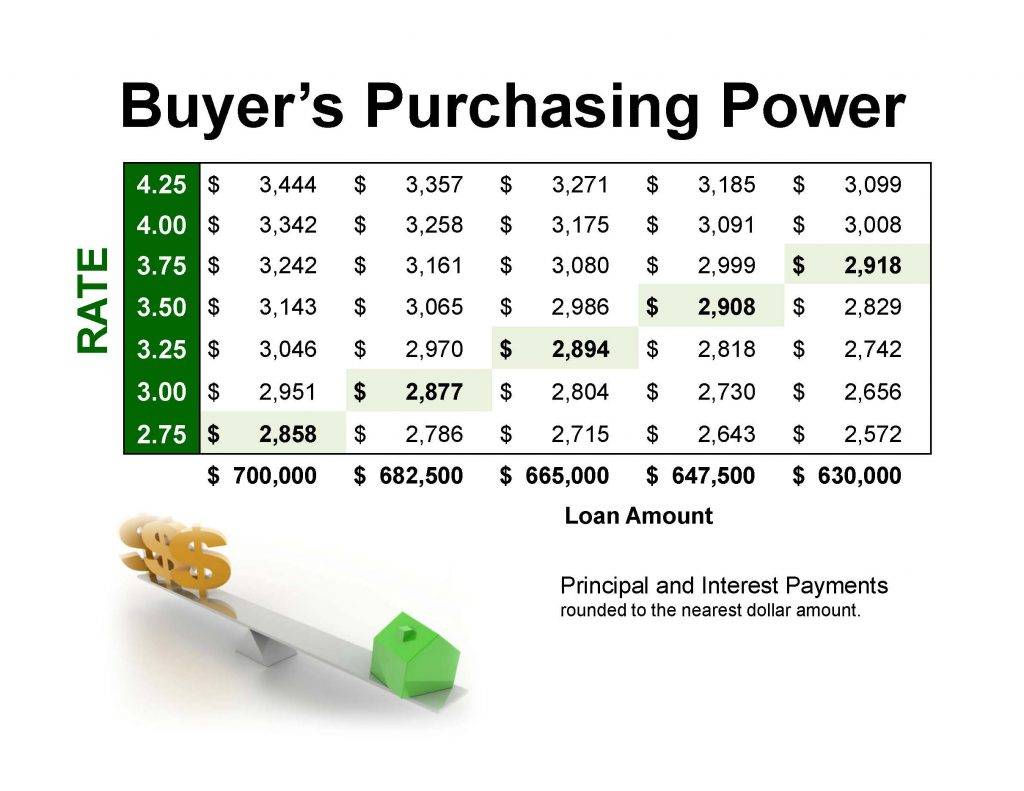

Finding the right loan officer and mortgage team is crucial when it comes to buying a home or refinancing. Vanessa and her team at Fairway Mortgage offers a variety of loan options that can help you achieve homeownership – with a speedy process. With current interest rates at a historic low at 3.2%, it offers more home affordability, in a competitive market.

Working with my clients, I strongly encourage them to get fully approved, which puts them in a better position when making an offer on a home. In this competitive market we are seeing buyers waive their financing contingency. There is definite risk in doing that, so it’s crucial that they work with a lender who can “get it done” and talk through all of the possible scenarios so that they aren’t surprised later on.

Vanessa and her team educate their clients from start to finish, through their home buyers guide and are truly passionate about being on your side as your own personal cheerleader to set you up for success in your loan process. Their loan process below is different from a lot of lenders as they speed up the process putting you in the best position to make an offer – or lower your current rate.

Loan Process Steps:

- Loan Application – Start by filling out a loan application online to start the process, once received Vanessa will set up a time for an in person or phone conversation about your loan.

- Income Factor – Vanessa will determine if you have factored in things like adding all your qualified income – some people don’t know other sources of income qualify.

- Debt To Income – Once Vanessa has all of your accurate information, W2’s, job, and debt she will calculate your debt to income ratio and determine what loan amount you qualify for.

- Pre-Underwriting – This is what sets Fairway Mortgage apart from other lenders. Vanessa will submit your loan through qualified underwriters, which is their loan ‘blessing’ you are fully pre-approved and put in a higher position in purchasing your home.

Whether you are looking to purchase a home or want some options I highly recommend Vanessa! You can visit their helpful resources online, and visit their loan options page to see what loan fits your needs. To set up a consultation with Vanessa visit her contact page, and follow Fairway on Facebook for the latest rate updates and loan resources.

Cheers!

Nicole